The Danger of Backfiring: Seizing Russian Assets

- Moses Zaree

- Mar 5, 2025

- 6 min read

Updated: Jan 26

How Seizing Russian Assets Could Cripple the UK’s Economy

Published: March 5, 2025

Author: Moses Zaree

The United Kingdom’s latest push to seize frozen Russian assets and use them to fund Ukraine’s war effort is being framed as a strategic necessity. The goal, British leaders argue, is twofold: to keep Ukraine’s military campaign alive and to persuade the United States, potentially under Donald Trump, to remain engaged in the conflict by spending the funds on American weapons.

However, beneath the surface of this seemingly bold maneuver lies a much greater risk: the potential unraveling of the UK’s financial credibility, the erosion of Western economic dominance, and the possible acceleration of a new global financial order that no longer relies on London, Washington, or Brussels as its key pillars.

History has repeatedly shown that weaponizing financial assets, especially those of sovereign nations, can produce unintended consequences. From Venezuela to Iran to Afghanistan, seizing or freezing assets has not only failed to achieve long-term strategic goals but has also contributed to the fragmentation of the very financial systems that Western economies depend on.

The UK’s proposal to confiscate Russian funds may seem like an act of financial warfare against Moscow, but in reality, it risks becoming an act of self-sabotage, one that could permanently damage London’s status as a global financial hub and drive investors away from Western institutions.

When the West Takes, Others Take Note

The UK’s move against Russian assets is not an isolated incident. In 2019, the Bank of England seized $1.95 billion in Venezuelan gold reserves, refusing to release them to the Maduro government under the justification that the UK recognized opposition leader Juan Guaidó instead. While this decision aligned with British foreign policy at the time, it had lasting repercussions.

Countries around the world, particularly those with strained relationships with the West, began reassessing where they stored their sovereign reserves. Why should they entrust their national wealth to a system that can unilaterally decide who has access to it?

A similar pattern emerged when the U.S. froze $7 billion of Afghanistan’s central bank reserves in 2022 after the Taliban took over. Half of those funds were later allocated to a trust for humanitarian aid, but the Afghan economy collapsed regardless. In Iran, more than $100 billion has been locked away in foreign banks since the 1980s due to sanctions, pushing Tehran to seek alternative financial partners, particularly China and Russia. In all these cases, the West’s control over financial systems was used as a geopolitical tool, but it also encouraged affected nations and their allies to build parallel economic structures, ones designed to avoid reliance on US or UK institutions altogether.

Now, with $300 billion of Russian central bank reserves frozen in Western institutions, the same dynamic is playing out again. France and Germany have already expressed strong opposition to outright confiscation, with Emmanuel Macron publicly stating that “these assets do not belong to us.”

The European Central Bank has echoed concerns that such a move would undermine trust in the international financial system. Yet, the UK, along with a few Eastern European nations, remains adamant that at least the interest generated from these frozen assets should be used.

If London proceeds with this plan, the consequences may not be immediate, but they will be irreversible. The signal it sends to the world is clear: sovereign assets in Western financial institutions are only safe as long as the political climate allows it. For countries like China, India, Saudi Arabia, and Brazil, this realization is a wake-up call. Why should they keep reserves in London or New York if they risk losing access the moment their foreign policy diverges from Western interests?

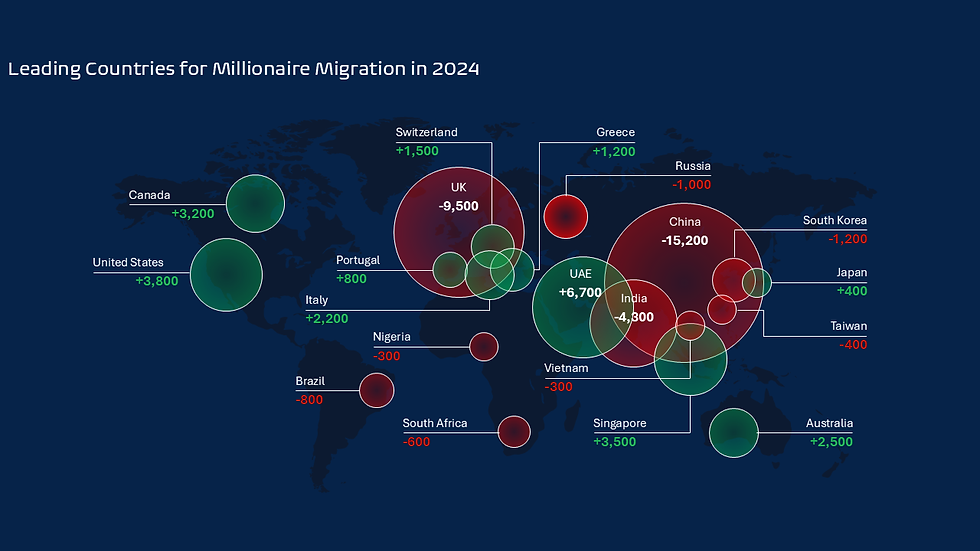

Source: Henley Global. Henley Private Wealth Migration Report 2024

This graphic highlights the top 10 countries projected to gain or lose high-net-worth individuals (HNWIs) in 2024. HNWIs are those with at least $1 million in liquid investable wealth, based on data from The Henley Private Wealth Migration Report 2024.

Key Insights:

UAE is set to attract the most HNWIs, outpacing the U.S. and Singapore.

China and the UK are expected to see the largest outflows of wealthy individuals.

A Self-Inflicted Wound

The UK’s financial sector is one of its greatest strengths, but also its greatest vulnerability. London has built its status as a global financial hub on the principles of legal certainty, neutrality, and the protection of property rights. If that reputation is shattered, the damage will be incalculable.

The UK already holds the highest exposure to foreign creditors among OECD economies. Confidence in British gilts, government bonds that rely on international investors, depends on the assumption that the UK respects property rights and financial contracts.

But if London demonstrates a willingness to seize sovereign wealth for political purposes, what’s stopping it from doing the same to private assets in the future? Investors from emerging markets may decide that the risk is simply too high, leading to capital flight from UK institutions to more politically neutral financial centers like Singapore, Hong Kong, or Dubai.

Meanwhile, the move could accelerate the global trend of de-dollarization and the development of non-Western financial alternatives. China and Russia have already been promoting the use of yuan and rubles in trade, and BRICS nations have been exploring ways to settle transactions without relying on Western banking systems. Seizing Russian assets would only validate their concerns and strengthen their resolve to build an alternative global financial order, one that sidelines London and New York entirely.

The Political Gamble: Fracturing the West, Strengthening the East

Beyond the economic risks, the UK’s position is also causing deep fractures within the Western alliance. France and Germany, already wary of American dominance in European security policy, are increasingly resistant to British-led efforts to seize Russian funds.

The broader EU bloc is also becoming frustrated with the reality that most of the money spent on the Ukraine war is flowing into the U.S. defense industry rather than strengthening European military capabilities. Since the conflict began, 78% of Ukraine’s arms imports have come from the United States, while the entire EU has received just 22% of the spending.

This discrepancy has not gone unnoticed. European leaders are questioning why their economies should bear the cost of a war that overwhelmingly benefits American defense contractors. If the UK pushes forward with seizing Russian assets only to redirect them toward U.S.-made weapons, it risks deepening European resentment and reinforcing the perception that Britain remains Washington’s most loyal servant, even at the cost of its own financial integrity.

Moreover, the move could provoke direct retaliation from Russia and its allies. If Moscow sees its sovereign reserves confiscated, it could nationalize British and Western assets within Russia, disrupting major UK-linked businesses. Even beyond Russia, other nations may take preemptive measures to reduce their exposure to the UK financial system, fearing they could be next in line for asset seizures.

Notes: This graphic illustrates Ukraine’s arms imports, highlighting the key suppliers and the distribution of military aid.

Key Insights:

The United States remains the largest supplier of arms to Ukraine, accounting for the majority of imports.

European nations collectively contribute a significant share, though their individual contributions vary.

NATO allies continue to be the primary sources of military aid, reinforcing Ukraine’s defense capabilities.

Non-Western suppliers have a marginal but growing role in Ukraine’s military procurement.

A Short-Term Victory, A Long-Term Defeat

In the immediate sense, seizing Russian assets may seem like a clever solution to Ukraine’s financial troubles. It provides a large sum of money without requiring additional taxation or borrowing and keeps pressure on Moscow. But in the long run, the costs far outweigh the benefits.

The UK’s financial credibility is at stake. The very institutions that have made London a financial powerhouse, trust, legal certainty, and neutrality, would be permanently undermined. Investors from around the world would have every reason to reconsider their holdings in British institutions. Meanwhile, the broader geopolitical impact would accelerate the decline of Western financial dominance, driving countries toward alternative systems that exclude the UK from the future of global finance.

Wars are not only fought on battlefields, they are fought in markets, banks, and currency reserves. In its attempt to weaken Russia, Britain may ultimately weaken itself. A world where sovereign wealth is no longer safe in Western institutions is a world where London loses its financial primacy. The greatest casualty of this policy might not be Moscow, it might be the City of London itself.

Comments